ライブチャットの利用方法や選び方、おすすめのライブチャットランキングを紹介します。

可愛い女の子とエロトークをしたり、その子のオナニー鑑賞をするのが目的ですよね?

アダルトチャットランキングでは、安全性が確認できている優良サイトの中から、コスパや女性の質などを徹底的に比較しました。

無料ポイントがもらえるサイトだけをご紹介するので、課金する前にまずはお試し利用しましょう!

ライブチャットとは?

ライブチャットとは、女性のライブ配信映像を視聴でき、希望すれば女性と二人きりでテレビ電話ができる夢のようなエロいサービスです。

いつでもどこでも好きなタイミングで、スマホやPCから利用することができます。

自宅でまったりと利用するもよし、出張先や旅先でハメを外して利用するもよし。

登録している女性もいろいろな人がいます。暇な女子大生と夜な夜なエッチなライブチャットをする日もあれば、昼下がりに人妻と浮気チャットをする日もあります。

エロチャット/アダルトチャット

ライブチャットにはアダルト要素が含まれるエロチャットと、アダルトが規約で禁止されているノンアダルトチャットがあります。

さらに、エロチャットの中でも、それぞれエロ度(露出レベルやプレイ内容)に違いがあります。

お好みのプレイが楽しめる適切なサイトを選びましょう。

- 浮気や下ネタなどのエロトーク

- チラ見せ、ポロリなどのお宝ショット

- エッチな脱衣チャット

- 生オナニーのライブ配信

- 相互オナニー見せあいプレイ

- SMプレイ

- イメプセックス

ノンアダルトチャット

ノンアダルトチャットとしては、ニコニコ生放送やYouTubeのストリーミング配信、ラインライブ(LINE LIVE)、イチナナライブ(17LIVE)、ツイキャス(TwitCasting)などが有名です。

ノンアダルトチャットは他にもありますが、こうした大手有名サイトの影響でほとんどが閉鎖されてしまいました。

当サイトでは、ノンアダルトチャットについても紹介しますが、メインはエロチャットです。

アダルトチャットの選び方

アダルトライブチャットの選び方は、ジャンルを決めることからはじめましょう。

「10代20代の若い女性」と「熟女人妻」のどちらが好みでしょうか?

また、がっつりエロを求めるなら「無修正」がおすすめです。

これとは別に、映像のない「音声だけのエロ電話」や、ライブではなく「過去の配信動画を見る」という選択肢もあります。

10代20代の素人女子

利用者数が最も多いのは、10代や20代の若い女の子たちが登録しているライブチャットです。

今どきの若い女の子と普通に会話したり、ちょっとエロトークしたり、想像以上に楽しいです。

さらに、女の子によってはかなり大胆なことをしてくれます。

正直、自分の半分以下の年齢の女の子と一緒に、相互オナニーする日がくるとは思いませんでした。

どんなに控えめに言っても最高です。

高校生とロリ

女性も男性も18歳未満は利用できません。

ライブチャットにいる一番若い女の子は18歳です。

ときどきかなりロリっぽい女の子もいますが、合法ロリなので安心してください。

ライブチャットは登録時に電話番号やクレジットカードで、年齢認証が必要です。

その辺は安心して利用することができます。

熟女人妻

通常のライブチャットでは若い女性の登録が多いのですが、熟女や人妻専門のライブチャットもあります。

少し残念ですが、熟女専門や人妻専門サイトは無く、「熟女人妻」とまとめられています。

それでも総合サイトに比べれば、はるかに好みの女性を探しやすいです。

熟女

熟女フェチといっても、「何歳から熟女なのか?」という個人差は非常に大きいですよね。

熟女や人妻専門のライブチャットでは、相手の年齢別に絞り込み検索ができるので、あなた好みの熟女を簡単に見つけることができます。

人妻

人妻ライブチャットの醍醐味のひとつは、寝取りによる背徳感ですよね。

それだけでなく、手軽に浮気気分を味わえるのも大きな魅力です。

なんといっても特筆すべきは、安全に浮気できるところでしょう。

人妻チャットは大丈夫?

サイトの外で実際に相手の女性と会ってしまうとアウトですが、ライブチャットのサイト上で浮気をしても、相手女性の旦那にあなたの個人情報が伝わることは一切ありません。

万一、相手の女性が離婚しても、あなたが慰謝料などの問題に巻き込まれることはないのです。

ちょっとずるい考えかもしれませんが、重要なポイントですよね。

無修正

ライブチャットはリアルタイムのテレビ電話やライブ配信映像なので、もともと性器に修正が入ることはありません。

そのため、普通のライブチャットでは、局部をカメラに写すことが禁止されています。

無修正チャットは大丈夫?

日本では、局部を露出するのは禁止されています。

ただ、例外的に無修正でオマンコが拝める無修正ライブチャットもあります。

運営拠点を海外に設置し、海外の法律下で運営しているサイトです。

オマンコぐちゅぐちゅのオナニーが見られるので、エロさはダントツです。

一方で、海外で運営するためにコストが増えてしまうようで、料金はやや高めの設定になっています。

海外で運営していても、日本人が利用する場合は日本の法律に則って運営するべきなのでしょう。

音声チャット

映像無しで通話のみができる音声チャットもあります。

昔のテレクラのように、素人女性とのエロ電話を楽しむことができます。

テレフォンセックスは顔が見えないので、視覚的なエロさは少ないのですが、逆に想像をかきたてられます。

また、電話ならではのイメージプレイ(イメプ)もおすすめです。

動画

生放送のエロ配信は、普通のAV動画よりも、リアルさや臨場感があります。

一方で、台本がしっかりと準備されたエロ動画はヌキどころがはっきりしていて、とても実用的です。

この2つの良いとこ取りが、ライブチャット動画です。

ライブチャットの臨場感は残しつつ、好きなところから視聴できる利便性があります。

ライブチャットサイトでは、過去の配信映像を録画していて、無料や有料で動画を視聴できるようになっています。

また、ライブチャットサイト以外でもライブチャット動画を見つけることができます。

ライブチャットの利用料金

ライブチャットの利用料金はサイトによって違います。

女性と二人きりでライブチャットをするツーショットのほうが高く、1人の女性が複数の視聴者に配信するグループチャットのほうが安いです。

局部もろ出しの無修正サイトは、利用料金がやや高いです。

| 料金(分) | グループ | 1対1 |

| 素人女子 | 100-200円 | 200-400円 |

| 熟女人妻 | 100-200円 | 150-250円 |

| 無修正 | 220円 | 450円 |

利用時間と利用料金

利用時間は個人差が多く、目的によっても異なります。

1分150円のライブチャットを利用する場合の支払い金額の目安は下記のとおりです。

| プレイ内容 | 時間 | 金額 |

| ①即抜き | 5分 | 750円 |

| ②ゆる抜き | 30分 | 4500円 |

| ③会話 | 30分 | 4500円 |

| ④フルコース | 60分 | 9000円 |

①抜き目的で、平日の寝る前に5分で処理する場合は、750円ほどですね。

②逆に休日に30分ほどかけてじっくりとオナニーする場合は、4500円ほどかかります。

③キャバクラ感覚で利用すると30分の利用で、同じく4500円ほどかかります。

キャバクラの基本料とだいたい同じですね。

実際のキャバクラに比べると、指名料や女性の飲み物代が不要なので、総額では安くすみます。

④私が自分へのご褒美として利用するフルコースは、まず30分ほどの会話をして、続いて30分ほどオナニーの見せあいプレイをしてフィニッシュします。

トータル60分で9000円ほどかかります。

キャバクラから風俗に続けて行くことを考えれば、非常に安上がりです。

夜のお店につきものの、ボッタクリや地雷女を引いてしまうリスクもないので、ライブチャットはお財布に優しいです。

キャバクラや風俗に比べれば、すごく安上がりのライブチャットですが、それでもお金はかかってしまいます。

ライブチャットは気になるけど、まずはどんなものか試してみたいという方もいると思います。

そこで、無料でお試しする方法を続けて紹介していきます。

無料ライブチャット

ライブチャットを無料で楽しむ方法を紹介します。

でも、無料で永遠に使い続けるような方法ではないので、過度な期待はしないでください。

無料ポイント

最も簡単で、有料と同じサービスを楽しむ方法は、無料ポイントの獲得です。

ほとんどのサイトでは、初回登録時にお試し利用できるように、無料ポイントが配られます。

このポイントだけでも十分に楽しむことができます。

複数のサイトに登録すれば、トータルで数万円分のポイントを獲得することができるので、かなり遊べます。

ただし、電話番号やクレジットカードなどで認証するので、一つのサイトに重複登録することはできません。

無料ポイントはサイト側のサービス精神によって成り立っています。

まったく利用する気のないサイトで、無料ポイントだけを目的に登録するのは控えましょう。

私もたくさんのサイトに登録しましたが、使ってみて良かったサイトは、継続的に利用させてもらっています。

無料サービス

ライブチャットサイトでは、一部の機能を無料で利用できます。

そうはいっても無料機能なので、ややしょぼいです。

多くのサイトでは待機映像を無料で見ることができます。

待機映像とは、ライブチャットを開始する前の女性の映像です。

もちろん、エロ行為はしていませんが、女性の素の姿を無料で覗き見できます。

無料サービスで特筆すべきは、DXLIVEです。

DXLIVEでは無料の会員登録をすると、待機映像が見られます。

加えて、会員向けに10分間無料でエロ行為を配信している女性がたまにいます。

女性のアピールタイムなので、良ければ継続するのですが、はじめの10分は無料で楽しむことができます。

常に開催されているわけではないので、ちょくちょくサイトにログインして確認してみましょう。

おすすめのライブチャット

10代から20代の素人女性が多いライブチャットのおすすめランキングを紹介します。

また、それぞれのライブチャットの料金や特徴、無料ポイントなどを比較解説していきます。

ライブチャット初心者の方は、ランキングの上位サイトを参考に選んでみましょう。

中級者の方は、ランキング内の利用したことがないサイトや、新しいサイトを探してみてください。

| 1位 | DXLIVE | 世界最強の過激エロチャット |

| 2位 | ジュエル | 安定の国産エロチャット |

| 3位 | モコム | スマホ専用アダルトチャット |

| 4位 | FANZA | AV女優がライブ配信 |

| 5位 | VI-VO | 新進気鋭のスマホチャット |

ジュエルライブとDXLIVEがおすすめです。

編集部でも意見が別れ、総合ランキングでは甲乙をつけられませんでした。

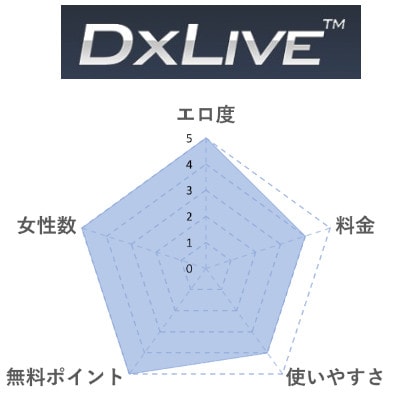

項目別に表にしてみました。

| 比較 | ジュエル | DXLIVE |

| 料金 | ◎ | △ |

| グループ | 150円 | 220円 |

| 1対1 | 250円 | 440円 |

| お試し ポイント |

100円購入で 1500円分 |

無料会員登録で 2400円分 |

| 無修正 | ✗ | △ |

| 相互オナ | ○ | ◎ |

コスパを求めるならジュエルライブ、過激なエロさを求めるならDXLIVEです。

DXLIVEは無料登録で2400円分お試しできます。

ジュエルライブも初回に100円だけ購入すると、1500円分のポイントがもらえます。

なかなか決めにくいという場合は初回お試しポイントを利用して、満足度の高い方をメインにするというのはいかがでしょうか。

DXLIVE

特典情報

- 会員登録で2600円(=$24)分の無料ポイント

- クーポン利用で、更に1200円(=$10)分を獲得

| グループ | 1対1 |

| $2 | $4 |

| 200円 | 400円 |

ココがおすすめ

- エロさNo.1の過激サイト

- 若くて可愛い女の子がたくさん

- オナニー鑑賞できる

ココがダメ

- 料金がやや高い

- 料金がドル表記

※アメリカで運営されているので、料金はドル表記です。クレジットカードなら自動的に円で決済されます。

アダルトライブチャットのなかで、圧倒的な人気を誇るのがDXLIVEです。

金額を気にせず、エロ目的で使うなら、DXLIVEが一押しです。

単純に、オマンコが見たいから過激なライブチャットを使うわけではありません。

オマンコが見られるレベルのエロさということは、ほぼ確実にオナニーまで進めるということです。

ライブチャットの相手は素人女性なので、先が読めない怖さがあります。

さんざん焦らされたあげく、おっぱいポロリだけで終わってしまったときの虚無感。

他のライブチャットで、こんな地獄のような辛い体験をした人たちが、DXLIVEの虜になっているのではないでしょうか。

逆に会話やエロトークだけで満足できる人には、割高なのでおすすめしません。

基本料金は他のライブチャットに比べて、やや高いです。

アメリカに運営拠点を置いているので、運営会社のコストがだいぶかかってしまうのでしょう。

DXLIVEに登録している女性も、アダルト要素が多い分だけ、他のトーク中心のライブチャットよりお小遣いが多いほうが嬉しいですよね。

DXLIVEのおすすめポイントは、初回登録時にもらえる無料ポイントがダントツに多いところです。

ライブチャットがはじめての方でも、無料でどんなものなのか知ることができるので、かなり良心的だと思います。

クーポンを使うと、約3600円分も無料で利用できます。

DXLIVEはアメリカで運営されているので、ポイント購入時はドルで支払う必要があります。

クレジットカードを使えば、クレジットカード会社が勝手に世界共通の換算レートで計算してくれるので、全く手間も費用もかかりません。

銀行振込は、海外送金手数料やら円為替手数料などを取られてしまうので、おすすめしません。

ジュエルライブ

お得情報

- 初回100円購入で1500円+10分無料チャット券

| グループ | 1対1 |

| 150円 | 250円 |

ココがおすすめ

- 国内最大人気のライブチャットサイト

- 若くて可愛い女の子がたくさん

- オナニー鑑賞できる

ココがダメ

- 局部もろ出しはNG

ジュエルライブは日本で最もメジャーなライブチャットサイトのひとつです。

10代から20代くらいまでの女性とライブチャットをすることができます。

国内サイトではトップクラスにエッチな配信を楽しめます。

登録女性数が多いので、女性の競争も多く、ランキング上位の女性はガッツリとエロ配信をしてくれます。

逆にオナニーもしないのにランキング上位にいる女の子は、本当にアイドル並みにかわいいです。

また、あまり人気のない女の子や、エロ配信をしない女の子を選ぶのもおすすめです。

普段チヤホヤされていない分、褒めてあげるとかなり喜んでくれて、それがかわいいです。

さらに、そんなときは余分にサービス♡してくれることもあり、ちょっと得した気分になります。

ジュエルライブは利用者も多く、コスパが非常に高いです。

もともと良心的な価格設定なのですが、既存会員向けに割引キャンペーンや割引イベントも頻繁に開催していて、好感がもてます。

無料ポイントは少なめですが、初回に100円購入すると大量にお試し利用できます。

昔は無料ポイントがもっともらえたのですが、利用する気もないのに無料ポイントだけ使う人が多すぎたのでしょう。

ただ、初回に100円購入すると実質3500円分も利用できるので、本気で使いたい人にとっては昔よりだいぶオトクになっています。

モコム

特典情報

- 会員登録で3500円分の無料ポイント

| 音声チャット | 1対1 |

| 200円 | 250円 |

ココがおすすめ

- 若くて可愛い女の子がたくさん

- オナニー鑑賞できる

ココがダメ

- 料金がやや高い

モコムはジュエルライブ同様、10代20代女性が多く登録しているライブチャットです。

スマホ向けのライブチャットなので、若い女の子たちが利用しやすいのでしょう。

スマホ向けのサイトなので、クレジットカードを持っていない人でも、電話番号だけで年齢認証できます。

PCからも利用できますが、スマホで利用するほうが使い勝手は良いです。

利用している女性は、ジュエルライブと同じ層なので、若くてかわいい子がたくさんいます。

エロさも十分あり、一緒に相互オナニーできる女の子も多くいます。

ちょっと気になるのは、利用料金です。

同タイプのジュエルライブと比べると、やや高いのが残念なところです。

スマホでの使い勝手がとても良いので、もう少し安くなるともっと利用者が増えると思います。

モコムは初回登録時に、無料ポイントがたくさんもらえます。

まずはライブチャットを無料で試してみたいという方におすすめです。

FANZA

特典情報

- 初回登録で1000円分の無料ポイント

| グループ | 1対1 |

| 100円 | 400円 |

ココがおすすめ

- AV女優の出演イベントがある

- 可愛い女の子が多い

ココがダメ

- 1対1のチャットが高い

DMMのアダルト部門がFANZAという名称に変更されました。

わたしたち利用者側の違いは特にありません。(DMMはいろいろな事業をやっているので、アダルトとそれ以外を明確に分けたかったようです。)

FANZAライブチャットの最大の魅力はAV女優とライブチャットができる点です。

一言で言えば、圧巻ですね。

手持ちのエロビデオのAV女優が、リアルタイムでエロ行為を披露してくれます。

テキストチャットを送れるので、どんな体勢になってほしのかや、どこを見せてほしいのかをお願いできちゃいます。

また、エロ行為だけでなく、日常的な会話もできます。

もちろんエロも欲しいところですが、ビデオで喘ぎまくっている有名女優の平常時の姿は貴重ですよね。

私は、AV動画のインタビュー部分が大好きなのですが、これに共感できる方ならわかると思います。

逆に、インタビュー部分を飛ばす方は、つまらないと感じると思うので、エロ行為が始まるまで待ちましょう。

ライブチャットは1分単位の課金なので、ちょくちょくアクセスして様子をうかがえば、ほとんどお金を使わずに、抜きどころまで待つことができますよ。FANZAの無料ポイントは少ないですが、AV女優とライブチャットをしたい人はFANZA一択です。

VI-VO

特典情報

- 無料登録で3000円分の無料ポイント

| 音声チャット | 1対1 |

| 180円 | 230円 |

ココがおすすめ

- 可愛い女の子が多い

- 新しいサイトなので意外と穴場

ココがダメ

- 大手に比べると女性数が少ない

新しいスマホ向けライブチャットです。

PCでも利用できますが、スマホでの利用を推奨します。

VI-VOは若い女性の登録者数が多く、基本的にみんなエロいです。

会話よりも、エロ行為がメインになります。

無料ポイントが多くもらえるので、気軽に試してみることをおすすめします。

ライブチャットの利用方法

ライブチャットの遊び方は、サイトから好みの女性の写真をクリックすると、ライブチャットルームに入室できます。

女性がライブ配信をすでにはじめている場合は、そのまますぐに参加することができます。

女性がチャットをはじめていない(待機状態)ならば、二人きりの1対1チャットかグループ配信かを申請することができます。

二人きりのチャットか、グループ配信かによって料金が異なるので、好きな方を選びましょう。

ライブチャットがはじめての方は、まずはグループチャットに参加して、どんなものなのか覗いてみることをおすすめします。

また、他の人が入室するまでは、グループチャットの料金で二人きりのチャットを楽しむことも可能です。

必要な道具

ライブチャットはほとんど道具がなくてもはじめることができます。

スマホの場合は、とくに道具は必要ありません。

音漏れ防止のために、イヤホンがあれば十分です。

パソコンの場合、女性が複数の視聴者向けにライブ配信しているグループチャットであれば、こちら側にマイクやカメラ機能は必要なく、イヤホンだけで十分です。

パソコンで二人きりのライブチャットを利用する場合は、マイクやカメラがあるとスムーズに相互オナニーをすることができます。

マイクやカメラがなくても、相手の映像を見たり、相手の音声をイヤホンで聞いたりすることができます。

その場合、テキストチャットで応対することもできます。

注意点

ライブチャットは風俗と違ってボッタクリ被害にあうことはありません。

ただ、なかには危険なサイトもあります。

大手企業が運営しているサイトであれば問題ないのですが、よくわからない会社や怪しい個人名義のサイトもあるので注意してください。

当サイトでは、編集部が利用した安全なサイトを紹介しているので、安心して利用することができます。

出会える?

ライブチャットの女性と出会うことができるのかどうか疑問に思っている人がいるかもしれません。

多くのライブチャットでは、出会うことや連絡先の交換を禁止しています。

テキストメッセージなどでメールアドレスを送ろうとすると、エラーになるサイトもあります。

一方で、連絡先を画像で見せたり、番号を音声で伝えたりすれば、運営側にバレることはありません。ただし、実際に会えるかどうかは、ライブチャット内で築いてきた関係性による部分が大きいでしょう。

仮にお互いが合意している場合も、人妻は注意してください。

会ってセックスしてしまえば、立派な不倫になってしまいます。

結論として、出会い自体を規約で禁止しているところもあるが、やろうと思えば可能です。